Dunida macdanta ayaa loo jiiday jihooyin dhan 2023: burburka qiimaha lithium, dhaqdhaqaaqa M&A ee xanaaqa, sanad xun ee cobalt iyo nikkel, dhaqaaqa macdanta muhiimka ah ee Shiinaha, rikoorka cusub ee dahabka, iyo faragelinta gobolka ee macdanta ee miisaan aan la arkin tobaneeyo sano. . Waa kuwan soo koobista qaar ka mid ah sheekooyinka ugu waaweyn ee macdanta 2023.

Sannad halkaas oo qiimaha dahabku dhigayo rikoodhka wakhtiga oo dhan waa inuu noqdaa war wanaagsan oo aan ku jirin warshadaha macdanta iyo sahaminta, taas oo ay jirto dhammaan buuqa ku hareeraysan biraha batteriga iyo kala-guurka tamarta.wali waxay u taagan tahay laf dhabarta suuqa yar yar.

Suuqyada birta iyo macdantu way kacsan yihiin wakhtiga ugu wanagsan - nikkel, cobalt iyo lithium qiimaha burburka ee 2023 waxa uu ahaa mid xad dhaaf ah laakiin gabi ahaanba ma aha mid aan hore loo arag. Soosaarayaasha dhifta ah ee dhulka, ilaaliyayaasha kooxda platinum-ka, kuwa raacsan macdanta birta, iyo kutaannada dahabka iyo qalinka ee arrinkaas, ayaa soo maray mid ka sii daran.

Shirkadaha macdan qodista ayaa ku fiicnaaday socodka biyaha jeexan, laakiin xidhitaanka qasabka ah ee mid ka mid ah macdanaha ugu weyn ee naxaasta ah ee soo galaya wax soo saarka tobanaankii sano ee la soo dhaafay waxa ay xasuusin weyn u noqotay khatarta ka weyn ee ay macdan qodayaashu la kulmaan in ka badan iyo in ka badan isbeddellada suuqa.

Panama waxay xidhay macdan naxaasta wayn

Mudaaharaadyo iyo cadaadis siyaasadeed ka dib, dhamaadkii bishii Nofembar dowladda Panama waxay amar ku bixisay in la xidho macdanta Cobre Panama ee First Quantum Minerals' ka dib go'aan ka soo baxay maxkamadda sare oo ku dhawaaqday qandaraaska macdanta ee hawlgalka.aan dastuuri ahayn.

Shaqsiyaadka dadweynaha oo ay ku jiraan u dhaqdhaqaaqa cimilada Greta Thunberg iyo jilaa HollywoodLeonardo Di Caprioayaa taageeray mudaaharaadyada iyola wadaagay muuqaaliyagoo ku baaqaya in "mega mine" ay joojiyaan hawlgallada, kuwaas oo si degdeg ah u faafay.

Bayaan ay soo saartay FQM Jimcihii ayaa lagu sheegay in dowladda Panama aysan siinin wax sharci ah shirkadda fadhigeedu yahay Vancouverraacitaanka qorshaha xidhitaanka, qorshe ay wasaaradda warshadaha ee bartamaha Ameerika ku sheegtay in la soo bandhigi doono bisha June ee sanadka soo socda.

FQMayaa xareeyaylaba ogaysiis oo gar-qaad ah oo ku saabsan xidhitaanka miinada, taas oo aan shaqayn tan iyo markii mudaharaadayaashaxannibay gelitaanka dekeddeeda dhoofintabisha Oktoobar. Si kastaba ha ahaatee, dhexdhexaadintu ma noqon doonto natiijada ay door bidayso shirkadu, ayuu yidhi maamulaha shirkadda Tristan Pascall.

Ka dib qalalaasaha, FQM waxay sheegtay inay ahayd inay si wanaagsan ugu gudbiso qiimaha macdanta $ 10 bilyan dadweynaha, oo hadda ay waqti badan ku bixin doonto la macaamilka Panaman ka hor doorashooyinka qaran ee sanadka soo socda. Saamiyada FQM ayaa kor u kacay usbuucii la soo dhaafay, laakiin wali waxay ka ganacsanayaan in ka badan 50% oo ka hooseeya heerkii ugu sarreeyay intii lagu jiray bishii Luulyo ee sanadkan.

Deficit naxaasta la saadaaliyay ayaa uumi baxa

Xiritaanka Cobre Panama iyo carqaladaynta hawleed ee lama filaanka ah ee ku qasabtay shirkadaha macdan qodista inay yareeyaan wax soo saarka ayaa la arkay ka saarida lama filaanka ah ee ku dhawaad 600,000 oo tan oo sahayda la filayo, taasoo suuqa ka wareejinaysa wax badan oo dheeri ah oo la filayo isu dheelitirnaanta, ama xitaa hoos u dhac.

Labada sano ee soo socda ayaa loo malaynayay inay noqdaan wakhti badan oo naxaas ah, iyada oo ay ugu wacan tahay mashaariic cusub oo taxane ah oo ka bilaabmay adduunka oo dhan.

Rajada laga filayo warshadaha inteeda badan waxay ahayd faa'iidooyin raaxo leh ka hor inta uusan suuqu adkeynin mar kale tobankan sano ka dib markii ay sare u kacday baahida loo qabobaabuurta korontadaiyokaabayaasha tamarta la cusboonaysiin karowaxaa la filayaa in ay isku dhacaan la'aanta miinooyin cusub.

Taa baddalkeeda, warshadaha macdanta ayaa iftiimiyay sida sahaydu u nugul tahay - haddii ay tahay mucaarad siyaasadeed iyo bulsho, dhibka horumarinta hawlgallada cusub, ama si fudud caqabadaha maalinlaha ah ee dhagaxyada ka soo jiidaya dhulka hoostiisa.

Qiimaha lithium-ka ayaa hoos u dhacay kor u kaca saadka

Qiimaha lithium-ka waa la dhimay 2023, laakiin saadaasha sanadka soo socda aad ayay uga fog tahay tusbaxa. Baahida lithium kabaabuurta korontadaweli si xawli ah ayuu u korayaa, laakiin jawaabta sahaydu waxay ka batay suuqa.

Sahayda lithium-ka caalamiga ah, ayaa dhanka kale, ku boodi doonta 40% sanadka 2024, UBS ayaa sheegtay horaantii bishaan, in ka badan 1.4 milyan oo tan oo lithium carbonate ah oo u dhiganta.

Wax soo saarka ee soo saarayaasha ugu sarreeya Australia iyoLaatiin Ameerikakor u kici doona 22% iyo 29% siday u kala horreeyaan, halka Afrika la filayo inay labanlaabto, oo ay wadaan mashaariicda Zimbabwe, ayuu yidhi baanku.

Wax soo saarka Shiinaha ayaa sidoo kale kor u qaadi doona 40% labada sano ee soo socota, ayay tiri UBS, oo uu wado mashruuc weyn oo CATL ah oo ka socda koonfurta Jiangxi.

Bangiga maalgashiga ayaa rajaynaya in qiimaha karbohaydrayt ee Shiinaha uu hoos u dhici doono in ka badan 30% sanadka soo socda, isagoo hoos ugu dhacaya 80,000 yuan ($14,800) halkii ton sanadka 2024, celcelis ahaan 100,000 yuan, oo u dhiganta kharashyada wax soo saarka ee Jiangxi, gobolka ugu wax soo saarka Shiinaha kiimikaadka.

Hantida lithium-ka ayaa wali ku jirta baahi badan

Bishii Oktoobar, Albemarle Corp.waxay ka baxday $4.2 bilyan oo ay kula wareegtayee Liontown Resources Ltd., ka dib markii haweeneyda ugu qanisan Australia ay dhistay dad laga tirada badan yahay oo xannibay oo si wax ku ool ah u jabisay mid ka mid ah heshiisyada biraha-batteriga ee ugu weyn ilaa hadda.

Isaga oo xiisaynaya in uu ku daro sahay cusub, Albemarle waxa uu daba socday yoolkiisa ku salaysan Perth muddo bilo ah, isaga oo raacaya mashruuceeda Dooxada Kathleen - mid ka mid ah dhigaalka ugu yaabka badan Australia. Liontown waxay ogolaatay shirkadda Maraykanka "ugu wanaagsan uguna dambeysa" bixinta A$3 saamiga bishii Sebtembar - qiimo ku dhow 100% qiimaha ka hor inta aan dulsaarka Albemarle la soo bandhigin bishii Maarso.

Albemarle waxay ku qasbanaatay inay la dagaallanto imaatinka maalqabeenada macdanta ee Gina Rinehart, iyada oo ah Hancock Prospecting.ayaa si tartiib tartiib ah u dhisay 19.9% saamigaLiontown. Toddobaadkii hore, waxay noqotay maalgeliyaha kaliya ee ugu weyn, oo leh awood ku filan oo ay ku joojin karto codka saamilayda ee heshiiska.

Bishii Disembar, SQM waxay la midowday Hancock Prospecting si ay u sameyso dalab macaan oo A $1.7 bilyan ($1.14 bilyan) oo loogu talagalay horumarinta Lithium Australiyaanka Azure Minerals, saddexda dhinac ayaa sheegay Talaadadii.

Heshiisku waxa uu siin doonaa soo saaraha lithium no.2 ee aduunka SQM in ay saldhig ku yeelato Australia iyada oo saami ku leh mashruuca Azure's Andover iyo iskaashi lala yeesho Hancock, kaas oo leh kaabayaasha tareenada iyo khibrad maxalli ah oo ku saabsan horumarinta miinooyinka.

Chile, Mexico waxay gacanta ku hayaan lithium

Madaxweynaha Chile Gabriel Boric ayaa ku dhawaaqay bishii Abriil in dawladdiisu ay hoos geyn doonto warshadaha lithium-ka ee waddanka gacanta dawladda, iyada oo adeegsanaysa qaab ay gobolku iskaashi la yeelan doonaan shirkadaha si loo suurtogeliyo horumarinta maxalliga ah.

Thesiyaasadda la sugayeySoo saaraha labaad ee ugu weyn adduunka ee birta baytariga waxaa ka mid ah abuurista shirkad qaran oo lithium ah, Boric ayaa yidhi.TV-ga qaranka.

Madaxweynaha Mexico Andrés Manuel López Obrador bishii Sebtembar ayaa sheegay in tanaasulaadyada lithium-ka ee dalka dib loo eegayo, ka dib markii Shiinaha Ganfeng bishii hore uu muujiyay in tanaasulaadkii lithium-ka Mexico la joojiyay.

López Obrador ayaa si rasmi ah u qarameeyay kaydka lithium-ka Mexico horaantii sanadkan iyo bishii Agoosto, Ganfeng wuxuu sheegay in mas'uuliyiinta macdanta Mexico ay soo saareen ogaysiis la-hawlgalayaasheeda maxalliga ah oo muujinaya in sagaal ka mid ah tanaasulaadkeedii la joojiyay.

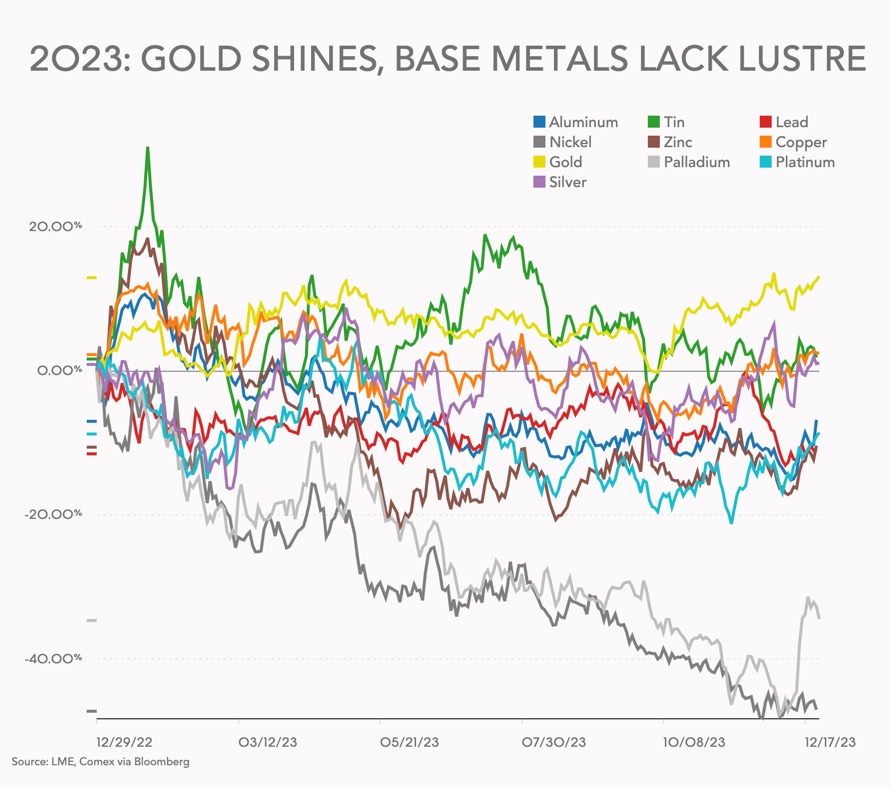

Gold si loo dhiso sanadka dejinta rikoorka

Qiimaha mustaqbalka ee dahabka ee New York ayaa dhigay heerkii ugu sarreeyay horraantii Disembar wuxuuna u muuqdaa mid dhaafi doona heerka ugu sarreeya ee sannadka cusub.

Qiimaha dahabka ee London ayaa gaadhay heerkii ugu sarreeyay abid oo ahaa $2,069.40 troy ounce xaraashka galabnimadii Arbacada, taas oo dhaaftay rikoodhkii hore ee $2,067.15 ee la dejiyay Agoosto 2020, Ururka Suuqa Bullion ee London (LBMA) ayaa yidhi.

"Ma ka fikiri karo muujinta cad ee doorka dahabka sida kaydka qiimaha leh marka loo eego xamaasadda ay maalgashadayaasha adduunka oo dhan u soo jeesteen birta intii lagu jiray qalalaasaha dhaqaale iyo juqraafiyeed ee dhowaan," ayuu yiri madaxa fulinta ee LMBA Ruth Crowell.

JPMorgan waxa uu saadaaliyay rikoodh cusub bishii Luulyo laakiin waxa la filayaa in heerka sare ee cusubi uu dhici doono rubuci labaad ee 2024. Saldhigga rajada JPMorgan ee 2024 – hoos u dhaca heerka dulsaarka Maraykanka – ayaa weli taagan:

"Bangiga wuxuu leeyahay celcelis ahaan bartilmaameedka qiimaha $ 2,175 ounce ee bullion rubuci ugu dambeeya ee 2024, iyada oo khataraha kor loogu qaadayo saadaasha hoos u dhaca Maraykanka ee khafiifka ah oo ay u badan tahay inuu ku dhufto wakhti ka hor inta uusan Fed bilaabin fududaynta."

Xitaa marka uu dahabku kor u kacay heerar cusub, kharashka sahaminta ee birta qaaliga ah ayaa la rusheeyey. Daraasad la daabacay bishii Nofembar guud ahaan miisaaniyada sahaminta macdanta ayaa hoos u dhacay sanadkan markii ugu horeysay tan iyo 2020, hoos u dhac 3% ilaa $12.8 bilyan 2,235 shirkadood oo u qoondeeyay lacag si ay u helaan ama u ballaariyaan dhigaalka.

Inkasta oo qiimaha dahabka ah ee quruxda badan, miisaaniyada sahaminta dahabka, oo taariikh ahaan ay ka shaqeynayeen qaybaha yaryar ee macdanta birta ama macdanta kale, ayaa hoos u dhacay 16% ama $ 1.1 bilyan sannadkii ilaa wax ka yar $ 6 bilyan, oo u dhiganta 46% wadarta guud ee caalamka

Taasi waxay hoos uga dhacday 54% sanadka 2022 iyada oo ay jirto kharashka badan ee lithium, nikkel iyo biraha kale ee baytariga, kor u kaca kharashka uraniumka iyo dhulalka naadir ah iyo kor u kaca naxaasta.

Sannadka Macdanta ee M&A, is-beddelka, IPOs, iyo heshiisyada SPAC

Bishii Disembar, mala-awaal ku saabsan Anglo American (LON: AAL)noqoshada bartilmaameedka la wareegidaby xafiiltamaan ama shirkad gaar ah sinaanta ku rakiban, sida daciifnimada ee saamiyada macdan qodayaasha kala duwan ay sii socoto.

Haddii Anglo American uusan u rogin hawlgallada oo qiimihiisu sii socdo, falanqeeyayaasha Jefferies ayaa sheegaya in aysan meesha ka saari karin suurtagalnimada in Anglo uu ku lug leeyahay isbeddelka ballaaran ee xoojinta warshadaha," sida ku cad qoraalkooda cilmi-baarista.

Bishii Oktoobar, saamilayda Newcrest Mining waxay si adag ugu codeeyeen inay aqbalaan ku dhawaad $17 bilyan oo dalab iib ah oo ka yimid shirkadda weyn ee macdanta dahabka ee Newmont Corporation.

Newmont (NYSE: NEM) waxa ay qorshaynaysaa in ay kor u qaado $2 bilyan oo kaash ah iyada oo loo marayo iibinta miinada iyo mashruuca kala wareejinta ka dib marka la helo. Soo iibsashadu waxay keenaysaa qiimaha shirkadda ilaa $50 bilyan waxayna ku daraysaa shan miino oo firfircoon iyo laba mashruuc oo horumarsan faylalka Newmont.

Burburinta iyo isdhaafsiga ayaa sidoo kale qayb weyn ka ahaa 2023 horumarka shirkadaha.

Ka dib markii lagu diiday dhowr jeer dalabkeedii ahaa inay iibsato dhammaan Teck Resources, Glencore iyo la-hawlgalayaasheeda Japan waxay ku sugan yihiin meel wanaagsansi loo keeno dalabka $9 bilyan ee qaybta dhuxusha ee macdanta Kanada ee kala duwanin la xidho. Dalabkii ugu horeeyay ee maamulaha Glencore Gary Nagle ee shirkada oo dhan waxa uu la kulmay mucaaradad adag xukuumada Liberal-ka ee Justin Trudeau iyo ra'iisul wasaaraha British Columbia, halkaas oo ay shirkadu saldhig u tahay.

Vale (NYSE: VALE) uma raadinayso la-hawlgalayaasheeda cusub unugeeda birta saldhigga ah ka dib iib sinnaan dhowaan ah, laakiin waxay tixgelin kartaaIPOunugga saddex ama afar sano gudahood, maamulaha guud Eduardo Bartolomeo ayaa sheegay bishii Oktoobar.

Vale wuxuu shaqaaleysiiyay maamulihii hore ee Anglo American Plc Mark Cutifani bishii Abriil si uu u hogaamiyo guddi madax-banaan si ay u kormeeraan $26-bilyan oo ah copper iyo unit nikkel oo la sameeyay bishii Luulyo markii shirkadda waalidka ee Brazil ay 10% ka iibisay sanduuqa Sacuudiga ee Manara Minerals.

Saamiyada naxaasta iyo macdanta dahabka ee Indonesian, PT Amman Mineral Internasional, ayaa kor u kacday in ka badan afar laab tan iyo markii la soo bandhigay bishii Luulyo waxaana lagu wadaa inay sii korodho ka dib marka lagu daro tusmooyinka suuqa ee soo baxaya ee November.

Amman Mineral $715 milyan IPO ayaa ahayd tan ugu weyn Koonfur-bari Aasiya dhaqaalaha ugu weyn sanadkan waxaana lagu tiriyaa baahida xooggan ee lacagaha caalamiga ah iyo kuwa gudaha.

Dhammaan macaamiishu si habsami leh uma socon sanadkan.

Waxaa lagu dhawaaqay bishii Juun, heshiis bir ah oo dhan $1 bilyan oo ay siisay sanduuqa jeegga maran ee ACG Acquisition Co si ay u heshonikkel reer Brazil ah iyo iyo macdan dahab ah oo naxaas ahka Appian Capital, ayaa la joojiyay Sebtembar.

Heshiiska waxaa taageeray Glencore, Chrysler waalid Stellantis iyo Volkswagen's batteriga PowerCo iyada oo loo marayo maalgashi caddaalad ah, laakiin markii qiimaha nikkelku hoos u dhacay waxaa jiray xiiso la'aan ka timid maalgashadayaasha laga tirada badan yahay marxaladda bixinta $ 300 ee bixinta sinnaanta taas oo ACG u qorsheysay qayb ka mid ah heshiis

Wadahadalladii 2022 ee lagu doonayay in miinada lagu helo ayaa sidoo kale burburay ka dib markii shirkadda Sibanye-Stillwater ay ka baxday. Wax kala iibsigaas hadda waa mawduucadacwadaha sharciga ahka dib markii Appian uu gudbiyay $1.2 bilyan dacwad ka dhan ah macdanta Koonfur Afrika.

Nikel sanka

Bishii Abriil, PT Trimegah Bangun Persada ee Indonesia, oo loo yaqaan Harita Nickel, ayaa soo ururiyay 10 trillion rupiah ($ 672 milyan) taas oo markaas ahayd waxbixintii ugu badnayd ee bilawga sanadka ee Indonesia.

Harita Nickel's IPO waxay si dhakhso ah ugu rogtay maalgashadayaasha, si kastaba ha ahaatee, qiimaha birta ayaa galay hoos u dhac joogto ah oo dheer. Nickel waa kan ugu waxqabadka xun biraha saldhigga ah, ku dhawaad kala bar qiimihiisu waa ka dib markii la bilaabay 2023 ganacsi ka sarreeya $30,000 tonne.

Sannadka soo socda maaha mid aad u fiican oo loogu talagalay naxaasta Ibliiska midkood sidoo kale soo saaraha sare ee Nornickel ayaa saadaaliyay korodhka korodhka sababtoo ah baahida baahida baabuurta korontada iyo kor u kaca sahayda Indonesia, kaas oo sidoo kale la socda lakab qaro ah oo cobalt ah:

"...sabato ah wareegga burburinta ee sii socda ee silsiladda sahayda EV, qayb weyn oo ka mid ah baytariyada LFP ee aan ahayn nikkel, iyo beddelka qayb ka mid ah BEV ilaa iibka PHEV ee Shiinaha. Dhanka kale, bilaabista awoodaha nikkel ee Indonesian cusub waxay ku sii socotay xawli sare.

Palladiumsidoo kale wuxuu lahaa sanad adag, oo hoos u dhacay in ka badan seddex meelood meel sanadka 2023 in kasta oo daahitaan soo daahay oo ka timid hoos u dhaca sanado badan uu ku dhacay bilowgii Disembar. Palladium wuxuu ahaa ganacsigii ugu dambeeyay $1,150 wiqiyadood.

Shiinuhu waxa uu leexiyaa muruqa macdanta muhiimka ah

Bishii Luulyo Shiinuhu wuxuu ku dhawaaqay inuu joojin doono dhoofintalaba bir oo dahsoon haddana muhiim ahiyada oo uu sii kordhayo dagaalka ganacsiga ee dhanka tignoolajiyada ee Maraykanka iyo Yurub.

Beijing waxay sheegtay in dhoofiyayaashu ay u baahan doonaan inay shati ka dalbadaan wasaaradda ganacsiga haddii ay rabaan inay bilaabaan ama ay sii wadaan dhoofinta gallium iyo germanium ee dalka ka baxsan waxaana looga baahan doonaa inay soo sheegaan faahfaahinta iibsada dibadda iyo codsiyadooda.

Shiinaha ayaa si xad dhaaf ah u ah isha ugu sareysa ee labada birta ah - oo ka dhigan 94% saadka gallium iyo 83% germanium, sida lagu sheegay daraasad Midowga Yurub ah oo ku saabsan alaabta ceeriin ee muhiimka ah sanadkan. Labada bir waxay leeyihiin noocyo badan oo takhasusle ah oo loo adeegsado samaynta chipsaming, qalabka isgaarsiinta iyo difaaca.

Bishii Oktoobar, Shiinuhu wuxuu sheegay inuu u baahan doono ogolaanshaha dhoofinta alaabada garaafyada qaarkood si loo ilaaliyo amniga qaranka. Shiinaha waa wax soo saarka iyo dhoofinta garaafka ugu sarreeya adduunka. Waxa kale oo ay sifeysaa in ka badan 90% garaafka adduunka shayga loo isticmaalo ku dhawaad dhammaan batariyada EV, taas oo ah qaybta taban ee batteriga.

Macdanta Maraykankaayaa sheegay in tallaabada Shiinaha ay hoosta ka xariiqday baahida loo qabo in Washington ay fududeyso hannaanka dib u eegista oggolaanshaha. Ku dhawaad saddex-meelood meel garaafyada laga isticmaalo Mareykanka waxay ka yimaadaan Shiinaha, sida uu qabo Isbahaysiga Innovation Automotive, kaas oo matalaya shirkadaha silsiladaha baabuurta.

Bishii Disembar, Beijing waxay mamnuucday dhoofinta tignoolajiyada si loo sameeyo magnets dhulka naadir ah Khamiista, iyada oo ku dartay mamnuucid horay loogu soo rogay tignoolajiyada si loo soo saaro loona kala saaro agabyada muhiimka ah.

Dhulku naadirka ahi waa koox ka kooban 17 bir ah oo loo isticmaalo samaynta birlabadaha oo tamarta u beddela dhaqdhaqaaq si loogu isticmaalo baabuurta korantada, marawaxadaha dabaysha iyo elektiroonigga.

Halka wadamada reer galbeedku ay isku dayayaan in ay iyagu samaystaanhawlgallada farsamaynta dhulka naadirMamnuucida ayaa la filayaa in ay saameyn weyn ku yeelato waxa loogu yeero "dhulka dhifka ah ee culus," oo loo isticmaalo matoorada baabuurta korontada ku shaqeeya, qalabka caafimaadka iyo hubka, halkaas oo Shiinuhu uu ku leeyahay sifeynta.

Asalka:Frik Els | www.mining.comWaqtiga boostada: Dec-28-2023